The Rule of 3’s For Optimal Money Management

- Jess

- Feb 15, 2024

- 5 min read

Updated: May 18, 2025

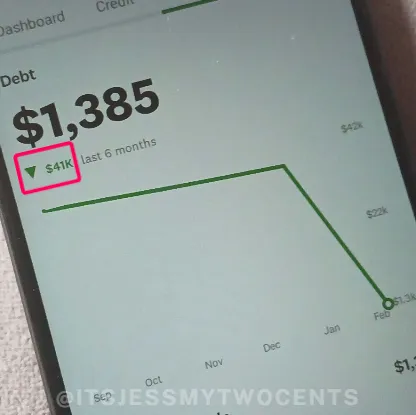

When it comes to money, I follow the rule of 3’s. It has helped me eliminate $41,000 of debt in less than 2 years, save for a second house, and pay all my bills.

I want to share with you a valuable rule that can benefit anyone, regardless of their salary level.

My realization of the “rule of 3” came when I noticed the absurdity of many apartments in the United States requiring tenants to earn 3 times the cost of rent.

That means if an apartment costs $1500 per month, you need to prove you make at least $4500 a month to qualify.

And for a 2 bedroom at $2400, you’d need to show proof of $7200 monthly income. That’s insane!

This made me think about reversing the rule — what if I live off only 1/3rd of my income? How much could I save and afford?

Here’s how this approach helped me get a house, eliminate debt, and build up my retirement savings.

(A screenshot from my Credit Karma account)

(Disclaimer: This article is not financial advice and is intended for educational purposes only. My articles are not sponsored or affiliated with any of the businesses, tokens, teams, or protocols mentioned. It is important to conduct thorough research and only invest an amount that you are comfortable potentially losing. For personalized financial advice, consult a professional.)

What Is the Rule of 3?

Let's answer these three important questions first:

What is the Rule of 3?

The rule of three involves splitting every payment you receive three ways.

How do the 3 rules of money work?

The Rule of 3 follows a similar concept to the popular 50/30/20 budget, but with a higher level of strictness.

Can I use the Rule of 3 for saving money?

Yes, it will save you money, but it requires a major lifestyle change.

How the Rule of 3 Works

Let’s use the example of Lucy who works for $20 an hour. Lucy is paid $1900 every two weeks for a total income of $3800 a month.

Lucy takes the $1900 and divides it by 3. $1900/3=$633

$633 goes to her expense account, which is where all bills/needs are spent.

$633 goes into her savings.

$633 split in half, 633/2=$316. $316 goes into investing, $316 goes towards debt repayments(if no debts then invest).

This means Lucy’s expense account would only be receiving $1200 a month, and that $1200 would have to cover rent, food, bills, and basic needs.

Based on Lucy’s financial situation, it may not be wise for her to rent an apartment by herself. Maybe she should consider options such as renting a room (which typically costs $600-$900 per month, depending on location), moving to a more affordable area, living with a partner, or staying with family members.

By doing this over the course of 12 months, Lucy would have:

$15,192 invested(or debt paid off).

$15,192 in savings.

That’s in just one year. Lucy’s investments will continue to grow and compound over time, but her savings can provide a nice cushion for emergencies or unforeseen expenses.

If this is what Lucy can accomplish with a wage of $20 an hour, imagine what's possible for higher salary earners to achieve in 12 months? Imagine what a couple with combined finances could accomplish.

(Photo by Medienstürmer on Unsplash)

The Rule of 3 For Solopreneurs

As a Solopreneur, I’ve learned to live off a third of my income so that I can continually invest in myself and improve my skills. It requires careful budgeting, but it also allows me to appreciate the simple things in life.

Instead of eating out, I cook more at home. And instead of living in an expensive city, I’ve found peace in the countryside. I’ve also become more self-sufficient by learning how to fix things around my house rather than paying someone else to do it.

But perhaps the greatest benefit is being able to save up for valuable assets like real estate, land, precious metals, crypto, and even businesses.

These are investments that bring long-term stability and growth, unlike constantly struggling to pay rent for a loft in the city.

Of course, if that’s your dream lifestyle, go for it! With the rule of 3, anything is possible with diligent saving habits.

Why the Rule of 3 Helps

Yes, it does suck. I never promised that this would be easy by any means. It’s terrible that our economy is like this, and I recognize that this is rough, trust me. Despite the challenges, I make sure to live off only a third of what I earn so that I can save for my future goals.

Even if my income increases, I stick to this rule of three because of three important reasons:

Inflation: Over time, the value of money decreases, making things more expensive even though wages may not increase.

Compound growth: By investing more, we can take advantage of compound interest and potentially offset the effects of inflation.

Building assets: Owning property or other assets can provide passive income, like renting out a house after fixing it up. But this requires saving up for a down payment.

What 3 Benefits You Gain

If you commit to living by the rule of 3 for just one year, you’ll experience some amazing benefits:

Better Money Management: By dividing your income into designated categories, you’ll develop financial discipline and learn how to spend wisely while saving consistently.

Increased Wealth: Saving and investing a 3rd of your earnings can lead to long-term financial success.

Lower Stress Levels: I thought by lowering my lifestyle I’d have more stress, but downsizing my lifestyle actually reduced my stress levels. Having a solid financial plan and living within your means can alleviate worries about future uncertainties.

My Final Thoughts

The rule of 3 has been a great method for managing my finances. It helps build discipline and encourages responsible spending by closely monitoring resources and planning out monthly expenses.

Personally, I’ve found it has sparked creativity in me to enjoy the things I want in life without breaking the bank.

For example, instead of costly indoor activities, I love spending time outdoors with homemade lemonade and sandwiches by the pond. I even grow my own vegetables and use worm fertilizer for my garden to save money while still eating fresh organic foods.

And it doesn’t mean I don’t get to enjoy technology and nice things, I have fiber internet and enjoy playing PC games and using my VR headset.

The takeaway is that you can have both — just don’t be afraid to take a different path than what society tells you to follow.

Sometimes, the detour leads you to exactly where you need to be.

That’s just my two cents on the matter.

Until next time,

-Jess

📌 Want more?

My Medium: In-depth and personal, paid content.

My Substack: Free, subscriber-only insights.

My Website Blog: Optimized guides for Freelancers and Solopreneurs.

Comments